What Type of Companies Get into Y Combinator?

Since its inception in 2005, accelerator Y Combinator has helped fund, advise, and build over 1,400 companies. Some of these have gone on to become billion-dollar household names—Airbnb. Stripe. Zenefits. Dropbox.

And a few have also died along the way. We wanted to understand these trends and see what makes a YC company. To do that, we have analyzed data on over 1,000 of these companies to see what they do, where they are, and how they work. Here's what we found.

The growth of YC & its companies

The program has slowly expanded from small beginnings in 2005 when it took in just 9 companies. The intake has grown by approximately 1/3 each year, taking in more and more companies each year. The only exception was 2013, when the accelerator intentionally took in fewer companies to deal with growth issues that had arisen with the summer 2012 batch.

After that hiccup, they continued to increase batch size all the way through to 2016 when there were almost two hundred companies combined in the winter and summer batches:

Growth of YC batches over time.

90% of these YC-funded companies are still active today, belying the Icarus trope associated with startups. Only 4% seemed to have died entirely, with another 6% acquired by other companies:

Proportion of active, exited, and dead YC companies.

If we look at the OG batch from summer 2005, most have exited. TextPayMe, an SMS-based transaction service, was acquired by Amazon only a year after its YC inclusion for an undisclosed amount. It now directs to Amazon Payments, though the TextPayMe service was deprecated in 2011.

Probably the biggest name from this genesis batch is Reddit. Started that year by Steve Huffman and Alexis Ohanian, it was also acquired a year later in 2006 by Conde Nast. Though it is now independent of Conde Nast, parent company Advance Publications is still the major shareholder.

In terms of funding raised, Loopt seems to have been the big winner in this initial batch, raising almost $40 million in total before it was acquired by Green Dot, a financial services company, in 2012.

This original batch does have a far greater proportion of exits than other batches. This could be that, as the elite of this new movement in 2005, they were hot property and quickly snapped up. Alternatively, this could be the fate of most of the companies, but these have had longer to play out.

The standard deal for YC companies is $120,000 funding for 7% equity. But money for these companies doesn't stop there. Combined, YC-funded companies have raised almost $10 billion in funding. The overwhelming amount of money raised, 97%, has been pumped into still active companies.

Dead companies contribute only about $50 million of that funding. Homejoy, the home-cleaning marketplace raised the majority of that funding—$39.7M, but ceased operations in 2015 as they couldn't find a path to profitability.

There is no obvious pattern when looking at funding through each year:

Funding raised per year.

This is because so many factors influence funding raised:

- Size of batch—there have been more companies available for funding in the latter batches. 2012 and 2013 both had multiple companies that raised over $100M in funding.

- Maturity—companies in the older batches have had more time to raise different rounds

- External factors—economic cycles have an effect on the financial ability to raise rounds

- Unicorns—some companies raise funding far exceeding their YC brethren. It is that last factor that is supremely evident in the graph above, particularly in 2009. The winter batch that year included Airbnb, who have raised almost $2.4B in funding.

Two companies, Airbnb and Dropbox (Summer 2007) have raised over $1B in funding. Another 13 have raised over $100 million:

Amount of funding raised by top YC companies.

There is no real doubt that YC is the premier seed accelerator. The fact that so many tech names have launched through the program shows that the team has a gift for identifying winners. This is backed up by the fact that so many seem to continue to be active—supposedly, 90% of startups fail, yet 90% of YC startups succeed.

This is no mean feat in an industry that is moving at such speed. YC has been around for more than a decade. 26 companies had already been through the program before the iPhone was invented. The fact that the accelerator continues to take on more companies, and more diverse companies, shows promise that it will still be relevant a decade from now.

The types of companies going through YC

Beyond the headline numbers, we wanted to look at what type of companies are being funded by Y Combinator. If you are at a startup that is thinking of applying, or just interested to know what is getting the top funding firms excited in tech, then knowing what type of companies are common within accelerators can give you a better understanding of the startup ecosystem.

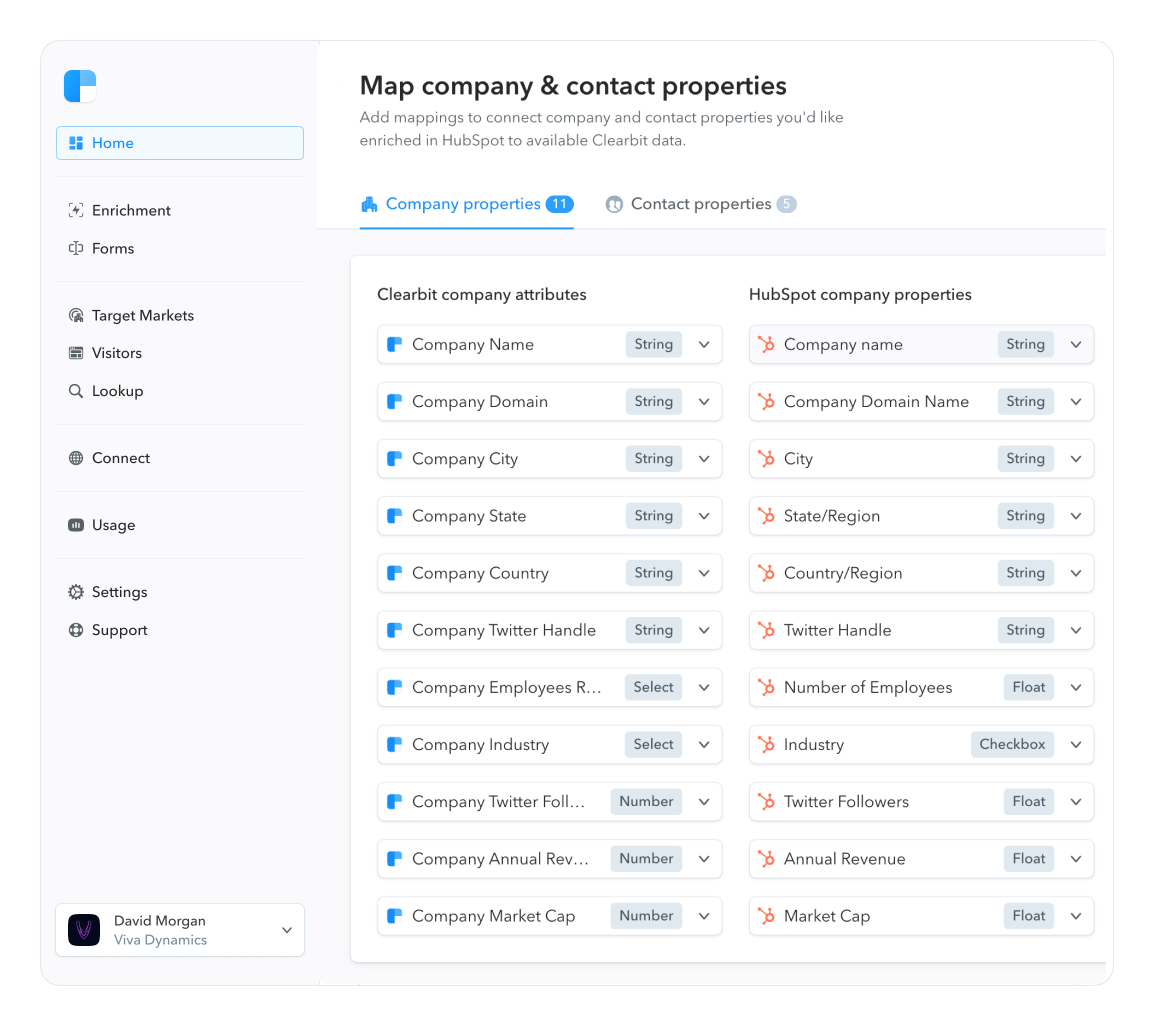

To do that we broke down companies according to their Clearbits tags. These tags are automatically generated based on website content, and allow for high-level categorization of companies. Companies can have more than one tag. For instance, a company could be tagged as both SaaS and B2B, or B2C and E-Commerce.

Since 2005, the number of B2B companies and the number of B2C companies have been fairly similar. About 950 companies are categorized as either B2B or B2C, with approximately 55% of these companies being B2B:

Proportion of B2B and B2C type companies in YC.

However, it wasn't always like this. The early batches were skewed more heavily towards B2C companies. It is only since 2011 that B2B companies have been in the majority, though 2016 saw a shift back to B2C dominance:

Change in proportion of B2B/B2C companies at YC over time.

When we break out the proportions of other type of companies, we see that SaaS is unsurprisingly the predominant type of company at YC:

Proportion of types of companies in YC.

However, there are a substantial amount of marketplace companies coming through YC, over 200 in this dataset. E-commerce is the main category with the fewest companies coming through the accelerator, though the proportion per year seems to have remained about steady in each batch:

Change in proportion of company types at YC over time.

If anything, though SaaS has striking dominance, it is on the wane, with proportional numbers dropping each year. Conversely, marketplaces seem to be taking more and more of the share with each passing year.

Going deeper into the type of companies in YC, we also looked at the sub-industry tags for these companies. Perhaps unsurprisingly, tech hardware and software account for just over 50% of all YC companies.

Proportion of industries in YC batches.

The 'Other' in that graph contains 67 other tags including advertising, human resources, financial services, payments, and aerospace.

This won't always be the case. Whereas early batches had more generally categorized companies, as tech pushes out into other fields, Y Combinator is also stretching out to help these types of company. As an example, here are the numbers of fintech and biomedical companies in different YC batches:

Increase in fintech and biomedical companies in recent batches.

Though fintech has been around since the very beginning (that one 2005 company is TextPayMe) it has grown substantially in the last few years, accounting for 15 companies in the 2015 batches.

The rise of biomedical companies has been even more impressive. There were 0 biomedical YC companies before from 2005 to 2013. There have been 30 in the three years since, with a massive 19 in the 2015 intakes. The winter 2015 batch contained 13 biomedical companies ranging from disease testing - Diassess, to affordable medical devices - Shift Labs, to Laboratories-as-a-Service - Transcriptic, to medical cannabis - Meadow.

This shows that even if you aren't straight “internet software,” YC could be the place for you. As tech expands out into other arenas, those other fields become interesting for VC firms and accelerators. If you are in finance, medicine, automotive, or aerospace, this could be the right time to be looking into applying.

And if you are straight SaaS, it's always a great time to apply.

San Francisco is the YC hub

Y Combinator is a 3-month residential program. The accelerator invites the founding team of the company to their HQ in Mountain View, California, where they can meet fellow founders, talk to experts, and participate in talks from Silicon Valley luminaries.

The benefits of asking everyone to a single place are the networking and access to a huge network of early adopters/customers. However, it does mean that the accelerator is dominated by companies that are easily able to base themselves in the Bay Area for 3 months. YC is heavily dominated by US-based companies, with about 86% of YC companies based within the United States:

Proportion of YC companies from different countries.

The accelerator does take applications from any country though. If successful, they will put international founders in touch with people who can help them get the required visas. However, some international teams might still be put off by the overhead required to pack up and head to another country for three months.

Outside the US, the next main contributor of companies is Canada, with about 3% of YC teams. Next up are the UK and India.

Within the United States, California predominates:

Proportion of YC companies from different states.

75% of American YC companies are California-based. The other significant home states for YC companies are New York, Massachusetts, and Washington. Within these states, New York City, Boston, and Seattle are the respective hubs. Unfortunately some states, particularly it seems in the Midwest, don't seem to have much representation at Y Combinator.

We've previously shown that San Francisco is still, by far, the main startup hub in the world. It is no surprise then that, within California, SF dominates in YC companies as well:

Proportion of YC companies from different cities in California.

Don't be fooled by that hotspot in LA, all the action is around the Bay Area:

Proportion of YC companies in the bay area*.*

That archipelago accounts for about 90% of the California-based YC companies.

This isn't some location-based form of nepotism. Rather the sheer totality of tech-based companies in Silicon Valley (about one per one thousand people) means that there are just far more available, and far more applying. In fact, this can explain why over a quarter of all YC companies are based within the San Francisco city limits.

Another reason for the high number in this locale could be post-YC relocation. This data is from the current locations of all YC companies. It could be that they all started in Kansas, but stayed in San Francisco!

The YC ouroboros

Any good tech company dog foods their product. It seems that YC dogfooding is common as well. Perhaps the ultimate affirmation of YC companies is that other YC companies use them.

Using our tech tag, we looked at the stacks underpinning each of the YC companies in our dataset. 11 YC companies are commonly part of the tech stack of other YC companies, with Mixpanel (s2009) being the most common:

YC tech used by other YC companies.

43% of YC companies are using Mixpanel for their analytics. That is pretty impressive for the analytics provider. Remember, not all YC companies are even tech companies, so might not need web/mobile analytics. Mixpanel seems to be the YC SaaS that is most useful across board.

In 2nd place was A/B testing platform Optimizely (w2010), used by about 22% of their fellow YC companies. These other companies were all used by over 10% of YC companies:

- Hosting service Heroku (w2008)

- Data platform Segment (s2011)

- Email API service Mailgun (w2011)

- Live chat tool Olark (w2009)

- Payment system Stripe (s2009)

From this, it seems that 2009 and 2011 were great years for YC SaaS.

Overall though, Google Analytics was the tech most often seen in YC stacks:

Tech used by YC companies.

This is unsurprising as it turns up in the stack of almost every company. Google Apps also has over 50% usage within the dataset. But it seems to be Mixpanel that is the hit with their fellow Y Combinators, being the 3rd most used piece of software by the group overall.

Three YC companies—Mixpanel, Optimizely, and Heroku are in the top 10 for YC tech stacks, with Segment, Mailgun, and Olark within the top 20. Of course, this doesn't include companies that are using Zenefits for backend HR functions, Dropbox for storage needs, or DoorDash when they are getting hungry!

Understanding Y Combinator

With over 1,400 companies going through the YC program it's honestly quite difficult to draw conclusions about what makes a great YC company. The fact that so many continue to succeed is a testament to the program and founders.

Not everyone can raise the type of money Airbnb or Dropbox saw, but a massive majority of these companies are not only succeeding, but thriving. They might not be huge names, but they form the backbone of the tech ecosystem. Developers now couldn't imagine life without Docker, Heroku, or Segment. Marketers couldn't survive without Mailgun or Olark. And anyone founder that hates paperwork thanks the stars for Zenefits and Gusto!

Probably the only concrete conclusion could be that the program will continue to diversify, while most likely being software dominated. The YC companies of five years hence will likely still be primarily SaaS and tech, but they will be pushing those technologies into completely new industries and verticals. This makes for an exciting future for the program, and for startups overall.