Customer lifetime value (CLV): What it is and how to calculate it

Existing customers are exponentially more valuable to your business than new customers. In fact, the probability of selling to an existing customer is up to seventy percent, while the probability of selling to a new prospect is only as high as twenty percent. In order to maximize profitability, you need to understand customer lifetime value (CLV).

CLV is a metric that can tell you a number of key things, including how much the average customer spends with your business and how effective your customer retention is, and can even shine a light the prospects you should be targeting.

In this article, we will detail customer lifetime value—why it’s important, ways to increase it, and how Clearbit can aid in your prospecting and customer retention efforts.

What is customer lifetime value?

Customer lifetime value is the estimated amount of revenue a customer will contribute to your business throughout the lifetime of the relationship.

This metric refers to individual customers or customer segments, and can be different depending on the audience being analyzed. For example, a company that does business with both tech firms and accountants will have different CLV calculations for each industry, and potentially for each individual business.

Overall, customer lifetime value is different from business to business because the amount of time a customer continues to spend money with a company depends on the industry, business model, consumer needs, and other factors.

Why is customer lifetime value important?

Customer lifetime value is important because it influences strategic decisions throughout your entire organization.

CLV helps you understand your prospects and can guide your spending on customer acquisition methods. Here are a few areas that can benefit from customer lifetime value insights.

Guides sales and marketing budget

Once you know your customer lifetime value, that information can guide you on how much your organization should be spending on customer acquistion efforts.

Your customer acquisition cost (CAC) is the total cost for your business to gain a new customer, and includes variables such as ad spend, employee salaries, and ad production costs. It’s important to understand this metric as well, because CAC and CLV are two pieces of the same outreach puzzle.

While the goal is to acquire a new customer for as little as possible, the golden ratio of CLV to CAC is 3:1. This means that if you know your customer lifetime value is $600, for example, your organization should be spending roughly $200 to acquire a new customer. This number should guide your outreach efforts, and can help identify and rectify any inefficiencies.

Helps define your ideal customer profile

An ideal customer profile (ICP) is a bio or snapshot of a company that would be the perfect fit for your product or service. In other words, it’s the ideal customer that your business could acquire.

This profile includes a number of firmographic and technographic data points such as industry, location, customer size, budget, business model, and more. Knowing your ICP through and through is crucial for effective customer acquisition—and your CLV plays a big part in that.

Once you calculate your customer lifetime value—and determine a goal for where it should be—if it’s too low,you can use that information to adjust and improve your sales and marketing efforts.

Enhances customer loyalty

If customers continue to spend money with your business, that means you’re doing something right—and vice versa.

Your CLV can tell your organization how long customers stick around, so if you are finding low retention numbers, it could indicate a problem with your offering. While CLV can diagnose the problem of customer retention, finding the source of it can be more difficult.

Maybe your sales process doesn’t set the correct expectation for the prospect, and after purchase they find your offering to be different than intended. On the other hand, maybe your customer support systems need reevaluation or you need to engage in better product onboarding.

If your CLV is too low, it may be wise to evaluate every touchpoint of the customer journey.

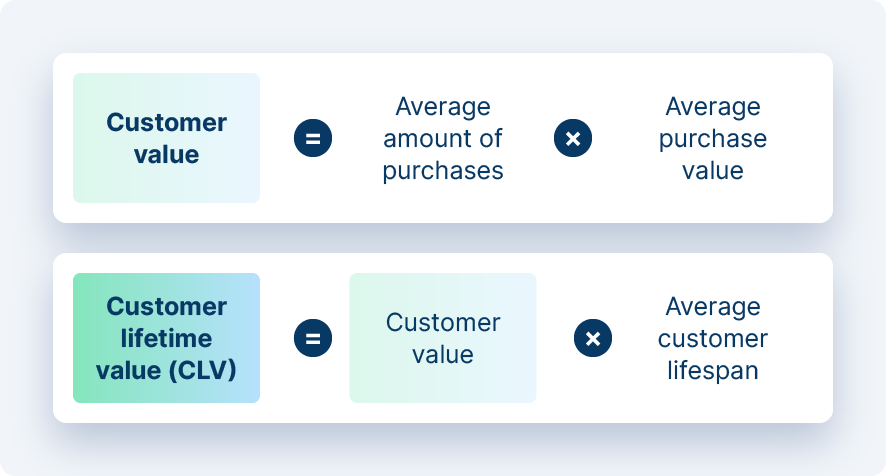

How to calculate customer lifetime value

As we’ve touched on, CLV is the projected revenue that each customer will bring in during their lifetime relationship with the company, and can be calculated with the following formula:

To illustrate the formula, let’s look at a fictional B2B SaaS Company. They offer a product on a subscription basis for $29 per month, and now intend to narrow down their ideal customer profile to optimize their outreach.

The first customer profile they are evaluating is startups, and they know that these prospects will only remain customers for one year on average due to funding uncertainty. The CLV for these customers looks like this:

Customer lifetime value = [$29 x 12] x 1

Customer lifetime value = $348

The second customer profile they are evaluating is mid-level corporations, and they know if they optimize their outreach and customer support, these prospects will remain customers for 18 months. The CLV for these customers looks like this:

Customer lifetime value = [$29 x 12] x 1.5

Customer lifetime value = $522

With this formula, it’s clear to see that Company B should be targeting mid-level corporations.

That said, CLV can be applied to any industry—not just B2B. A retail store, for example, would have to evaluate how much an average customer spends in-store, how often they shop there, and how long they continue the relationship with the company.

What is the difference between CLV, LTV, and CAC?

CLV, LTV, and CAC are all related metrics that determine how much it costs to acquire a customer and how long they continue the business relationship.

CAC

As we mentioned above, customer acquisition costs refers to the total cost for a business to gain a new customer, and includes variables such as ad spend, employee salaries, and ad production costs.

CLV vs. LTV

Customer lifetime value and lifetime value (LTV) are both metrics that help determine how much money a customer will spend during their lifetime relationship with a business. The main difference is that CLV refers to individual customers or prospect pools, while LTV refers to a business’s entire customer base.

For example, let’s look at a retail golf store. Its CLV metrics could analyze customers that play every weekend, every month, or only a few times a year. Its LTV, however, refers to every customer that shops in their store, regardless of qualifiers.

How to increase customer lifetime value

Now that we’ve covered why CLV is important for your organization, let’s go over a few ways you can increase it.

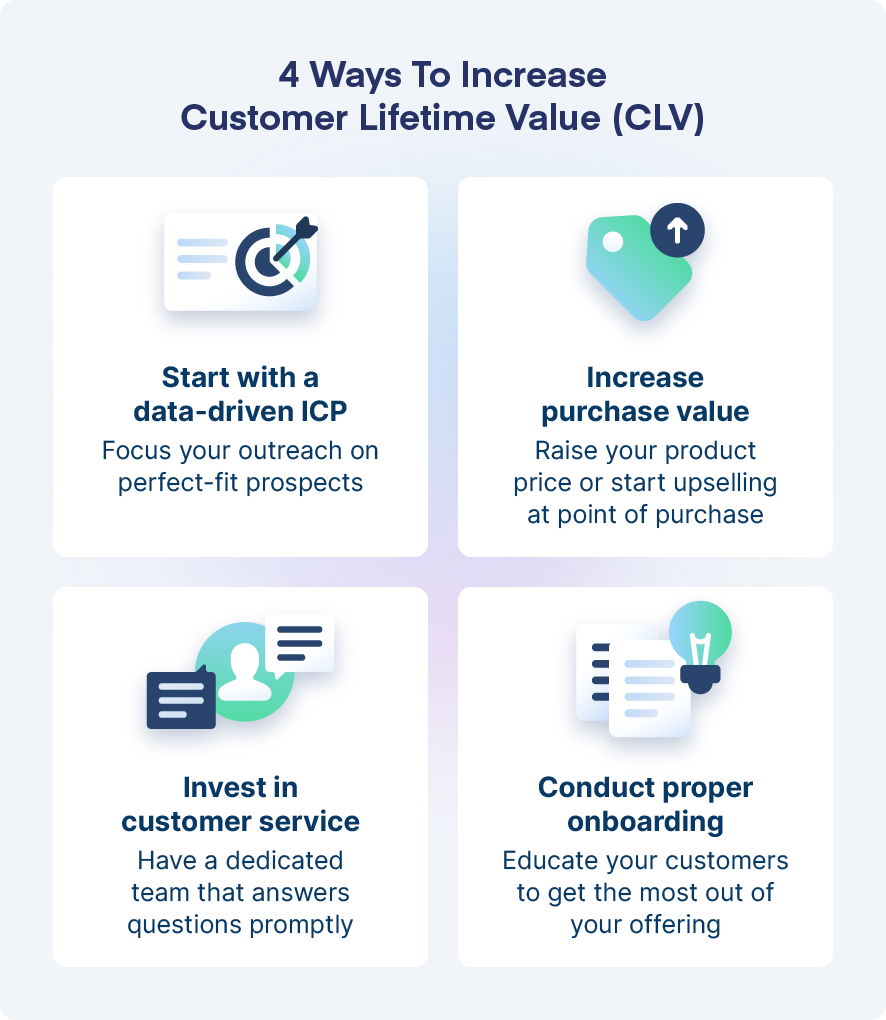

Start with a data-driven ICP

One of the most important factors for increasing customer lifetime value is to make sure you are targeting the right prospects that will stick around after the initial purchase.

As we touched on above, an ideal customer profile is a snapshot of the perfect business or individual for your offering—and that information should guide your outreach efforts. When you target the prospects that will get the most value from your business, you are targeting those that have a larger potential for retention because your offering is made for them.

To ensure that you are targeting these prospects effectively, you should also be engaging in advanced personalization. When you personalize the messaging on your website, emails, ads, and more to resonate with your ICP, you are engaging in outreach that will acquire and attract the right prospects for increasing CLV.

Increase purchase value

An easy way to increase CLV in a short period is to increase the average purchase value, which can be achieved in two ways.

First, simply increase the price of your product. You need to be diligent here to ensure you aren’t pricing out your ICP, but if your market research tells you that your product is cheaper than other options on the market, this approach could be something to consider.

The second, and more effective, method is to increase the average order value. This can be achieved by suggesting other products at checkout, similar to how Amazon displays a “frequently bought together” section once a customer is ready to pay. If your business has an opportunity to upsell and suggest additional products near the point of purchase, it could be a good strategy to increase your order value.

Invest in customer service

Outstanding customer service can make even the most trepidatious prospects stick around longer—in fact, ninety-three percent of customers will make repeat purchases at a company that has excellent customer service.

The first step is to have a dedicated customer service team. This part of your organization should be involved with answering customer questions promptly, providing rapid support, and giving personalized recommendations and other services when appropriate.

The most important thing to remember is that the customer journey doesn’t end when the prospect makes a purchase—they should still be given the same attention and support they received before they gave you their business.

Conduct proper onboarding

Proper product onboarding is a step that could be included under the umbrella of customer service, but its importance to customer retention demands its own talking point.

Onboarding involves being a virtual tour guide to your customers—showing them your product, the ways it can help them, and giving them reasons to stick around. After all, if your prospect doesn’t know how to make the most of your offering, they may become overwhelmed or underwhelmed and end the business relationship.

You’ll want to start the onboarding process within the first few days after the initial purchase to ensure the customer is fully up to speed. Additionally, you’ll want to ensure that your customers are fully adopting the product and getting the most use out of it as they can.

Plan a series of onboarding training calls or courses to ensure that your new customers are given the best chance to succeed.

Customer lifetime value FAQ

Finally, we will wrap up with a few frequently asked questions about CLV.

What is a good customer lifetime value ratio?

Customer lifetime value can be compared to customer acquisition cost to determine a good ratio for how much you should be spending on outreach. A good ratio for CLV to CAC is 3:1.

What does a higher or lower CLV mean?

A higher or lower CLV can indicate how well your business retains its customers. A lower CLV means customers aren’t sticking around, and may indicate problems with your product or customer support. A higher CLV means customers are staying dedicated to your business, indicating that you are supporting them and providing continuous value.

Clearbit starts the customer journey off right

Customer lifetime value is a crucial metric that can tell you how much the average customer spends with your business and how effective your customer retention is. This information can be used to target the right prospects, guide outreach efforts, and ensure your organization is operating at peak efficiency.

That said, to take full advantage of your CLV, you’ll need the right tools. Learning who your best-fit prospects are through data enrichment as well as personalizing content to best resonate with them is key to attracting the right prospects that have the highest potential for retention.