Building your Ideal Customer Profile through Enrichment

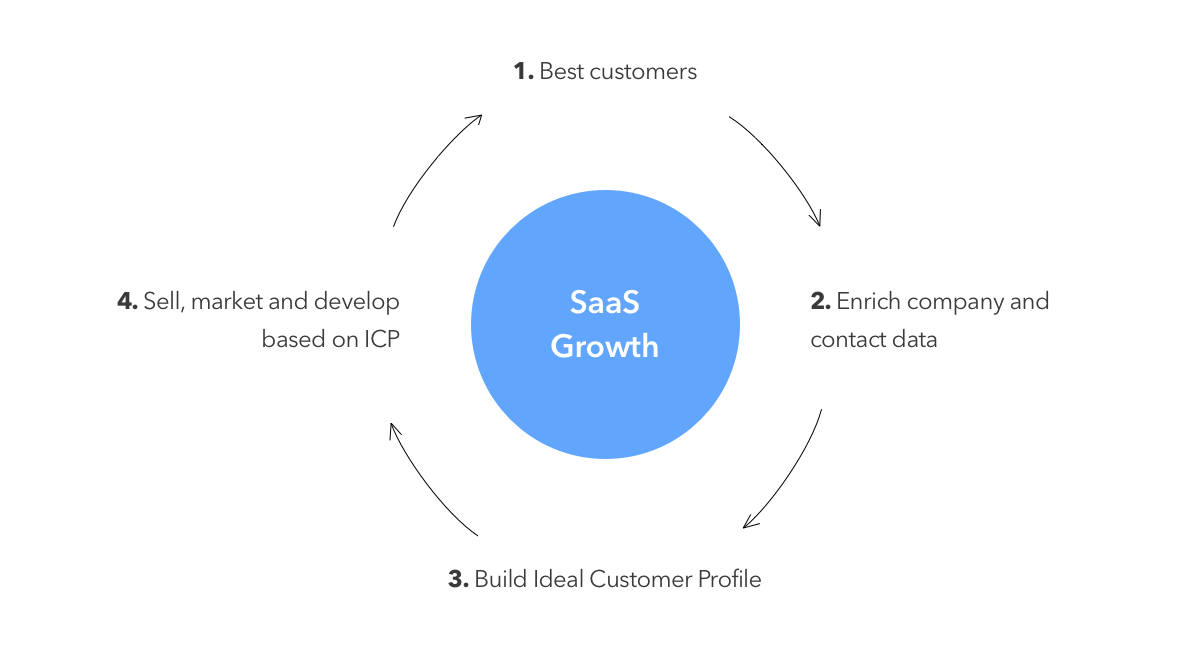

SaaS growth is all about finding clones of your best customers. Find the right clones and you get growth. Find the wrong ones and you get churn, support costs, and struggle. If you have 10 customers in SaaS, you have something. As Jason Lemkin says, those 10 customers are the basis for all future customers:

"...your 1,000th customer most likely will be just like your 10th, in concept and spirit, in category and core problem solved, in pain point at least."

Therefore, a critical question companies must ask themselves is: Who is our ideal customer?

Ideal customer profiles (ICPs) help you in two ways:

-

Identify good potential customers: Discover attributes that link your best customers. Then, find other companies that match these profiles.

-

Align your team to target them: Help your employees understand who they are developing/marketing/financing the product for.

Here's how to do it in 6 simple steps.

1. Start with your best existing customers

Best can mean different things depending on the maturity of your company. If you are fairly new and customers haven't had time to complete their lifecycle with you, high MRR could be a good proxy for “best”. However, if you are more mature, then the companies that find success with you are probably those with the highest lifetime value or the highest upsell.

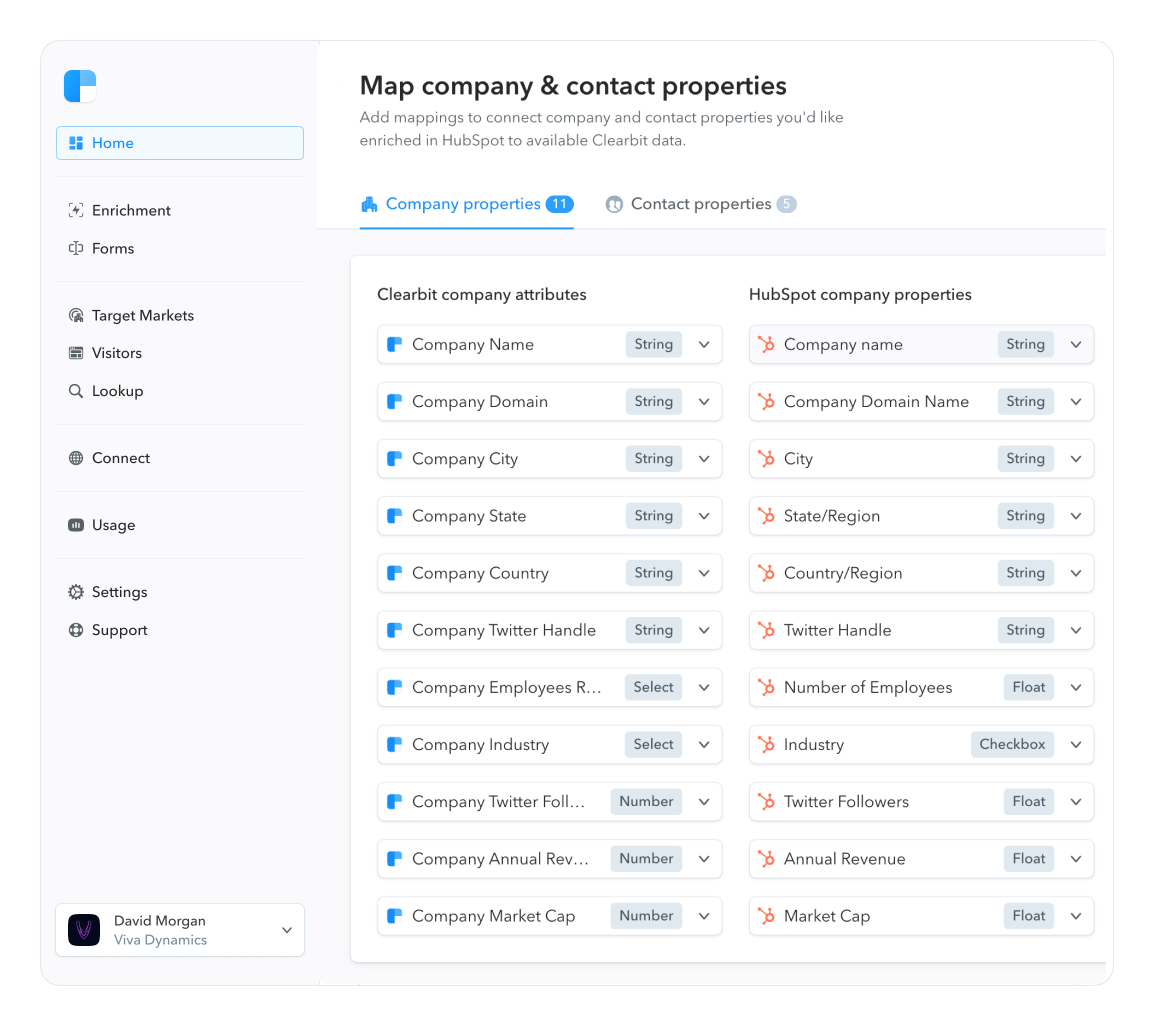

2. Enrich the customer data

Use Enrichment to append company and contact details to your customer records. At this point the company information is more relevant, but you can enrich the contacts too. Ideal customer profile ≠ buyer personas but the personal information will be vital when building out your buyer personas in step 4. Ideal customer profiles and buyer personas also provide the foundation for account-based marketing.

Let’s say one of your best customers is the chat tool Drift, in terms of MRR and LTV. By enriching drift.com, we get this information:

"id": "323cfe10-f348-4a90-a914-bc867194808d",

"name": "Drift",

"legalName": "Drift Inc",

"domain": "drift.com",

],

"category": {

"sector": "Information Technology",

"industryGroup": "Software & Services",

"industry": "Internet Software & Services",

"subIndustry": "Internet Software & Services"

},

"tags": [

"SAAS",

"Mobile",

"B2B",

"Information Technology & Services",

"Technology"

],

"foundedYear": 2014,

"type": "private",

"metrics": {

"employees": 140,

"employeesRange": "51-250",

"marketCap": null,

"raised": 107000000,

"annualRevenue": 10000000-50000000,

}

This tells us that Drift is a private SaaS B2B tech company, founded in 2014, has 140 employees and raised $107M.

If we did the same with another customer, Jeanne Hopkins, CMO at network monitoring firm Ipswitch, it would give a slightly different profile. The data would show Ipswitch is a private SaaS B2B enterprise tech company, founded in 1991, has 300 employees and hasn't raised capital.

Rinse and repeat for all your best customers.

3. Segment into profiles

The enriched profiles of Drift and Ipswitch are very similar. This gives you the chance to narrow down your ICP. Both are private B2B SaaS companies in the USA. It is best to contain your segmentation to just 3-5 possible profiles. Though FOMO will set in, this allows your team to better understand these customers and define product, messaging and pain points for just them.

Drift and Ipswitch are similar in a number of ways, but there are a few axes where the companies diverge:

foundedYear: Ipswitch has been running for over 25 years, whereas Drift is only a couple of years old.

raised: Drift have recently raised $15 million in funding, whereas this entry is null for Ipswitch.

employees: Drift has 140 employees, and Ipswitch has 300, putting them in the 251-1000 range.

We can segment these two companies into different possible profiles:

-

Established: A 10+ year old company, with a large employee base that is revenue-positive.

-

Mature startup: A young (2-5 year old) company, with less than 150 employees and is using funding to expand.

4. Transfer into personas

With just those two ideal customer profiles, separate marketing channels start to appear. Mature startups might respond better to a marketing-led inbound campaign, whereas established big business will require a sales-focused outbound strategy.

Company (firmographic) data is a great starting point, but for the extra mile you need contact data. Contact data allows you to build buyer personas which is an extension of your ICP. Adding personal information will help you understand the motivations of the individuals at your target customer companies.

Staying with Drift and Ipswitch, enriching David Cancel's (the CEO at Drift) profile gives this:

{

"person": {

"id": "faff3b93-f6c9-4334-b86e-b5bb169d6919",

"name": {

"fullName": "David Cancel",

"givenName": "David",

"familyName": "Cancel"

},

"email": "david@drift.com",

"employment": {

"domain": "drift.com",

"name": "Drift",

"jobTitle": "CEO",

"role": "ceo",

"seniority": "executive"

},

}

Whereas enriching Jeanne Hopkins’ (the CMO at Ipswitch) profile gives this:

{

"person": {

"id": "b0525d8e-0866-41d4-94c5-04465618fb23",

"name": {

"fullName": "Jeanne Hopkins",

"givenName": "Jeanne",

"familyName": "Hopkins"

},

"email": "jhopkins@ipswitch.com",

"employment": {

"domain": "ipswitch.com",

"name": "Ipswitch",

"jobTitle": "Executive Vice President & CMO",

"role": "marketing",

"seniority": "executive"

},

}

David is the CEO of a mature startup, Jeanne is the CMO of an enterprise company.

Each have different pain points and jobs that they are trying to achieve with the product. If you are reaching out through sales and marketing to each of these different buyer personas [{CEO, mature startup}, {CMO, enterprise}] you need to personalize your messaging to each.

5. Test

The next step is to take these into the wild and test your ICP hypotheses. Are these really the best companies for your product? Potential avenues for experimentation are:

-

Restructure your pricing to appeal directly to each of your ideal customer profiles. In this case that might be a mid-tier for mature startups and an enterprise plan for large businesses.

-

Create different content for the separate buyer personas. Here, that might mean developing tactical blog content for SaaS CEOs and more strategic whitepapers for enterprise CMOs

-

Use this information in lead generation. Find similar companies in each ideal customer bracket and proactively reach out. Get feedback from your sales team to check for an improvement.

The data points to measure success for these experiments are fairly simple: more, better customers. If testing shows that these aren't customers that are ideal for you, you can head back to your current customers and segment along different axes—sector, revenue, location.

6. Repeat

As your product and company evolves, so do your customers. The process of defining your ideal customer profile should be repeared at a regular cadence.

Your ideal customer profile is a living, breathing definition of your best customers. Using Clearbit, you can immediately enrich new customers as they come through your door, improving your ICP over time. Use this to hone your product, better target sales & marketing, and you will continue to grow with customers that fit your business.

Learn how to define your Ideal Customer Profile and activate your ICP throughout the funnel in our latest book with HubSpot, How to Scale Your Business with Your Ideal Customer in Mind

Learn how to define your Ideal Customer Profile and activate your ICP throughout the funnel in our latest book with HubSpot, How to Scale Your Business with Your Ideal Customer in Mind